Table of Contents

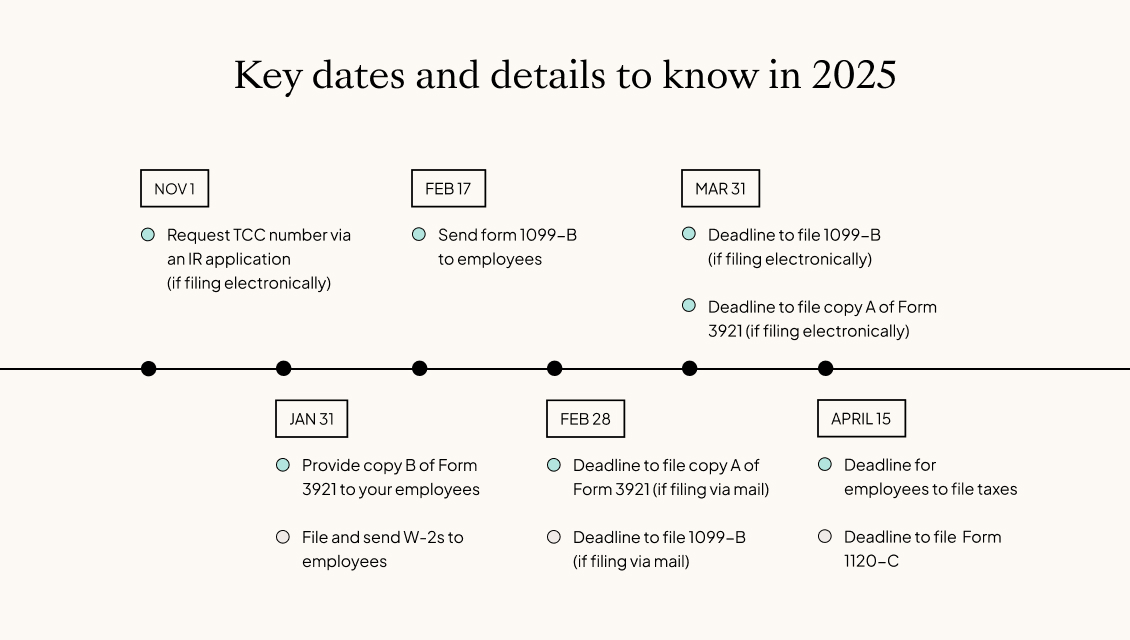

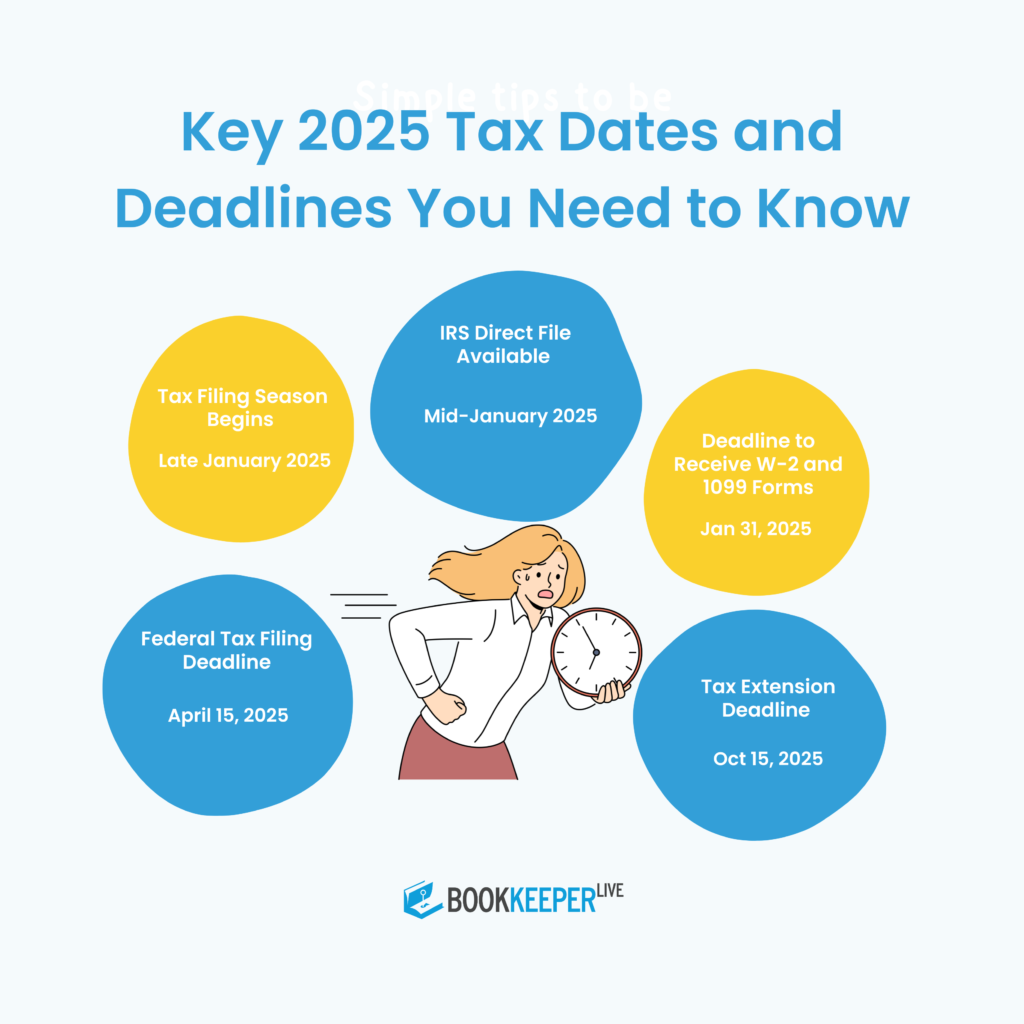

- 2025 2025 Deadline - Jacob M. Beaver

- Business Tax Deadlines 2025: Corporations and LLCs

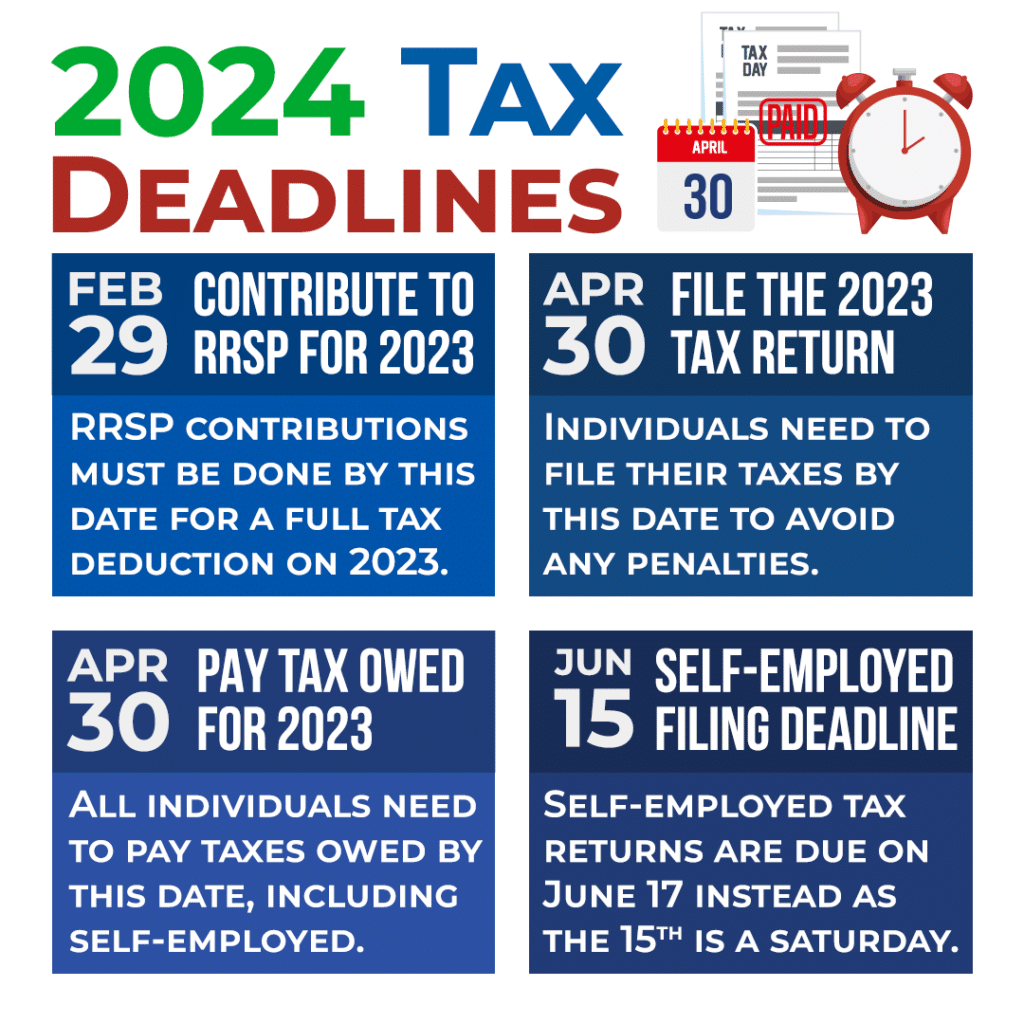

- Income Tax Filing Date 2025 - Bette Sybilla

- Why CPA need Outsourcing Tax Preparation Services?

- 2025 Tax Deadline Calendar - Aya dekooij

- Business Tax Deadlines 2025: Corporations and LLCs

- Business Tax Deadlines 2025: Corporations and LLCs

- Tax Extension Deadline 2025 - Quade Vacumm

- Business Tax Deadlines 2025: Corporations and LLCs

- Tax Payment Deadline 2025 - Ardene Carlynn

Which States are Eligible for the Extended Tax Deadline?

What is the New Tax Deadline?

The IRS has extended the tax deadline for affected taxpayers until May 15, 2023. This means that individuals and businesses in the eligible states have an additional 30 days to file their tax returns and make payments without incurring penalties or interest. The original tax deadline was April 15, 2023, but the IRS has recognized the need for an extension due to the extraordinary circumstances.

Who is Eligible for the Extended Tax Deadline?

The extended tax deadline applies to all taxpayers who reside in or have a business in the affected states. This includes: Individuals Businesses Tax-exempt organizations Estates and trusts Taxpayers who are eligible for the extension do not need to take any action to receive the extra time. The IRS will automatically apply the extension to all eligible taxpayers.